By: Ashlee L. Lewis-Staff Writer, The Drive Student Blog

In my adult life, I’ve thought numerous times, “Why didn’t I learn this in school?” The traditional education system seems to be designed to prepare students for success in their chosen career paths and does little to aid in the preparation for independent living. One of the most valuable lessons that I’ve learned outside of the classroom is that cash is king but credit is power. Our credit histories and scores are constantly being evaluated by creditors, varying from major cellphone companies to mortgage companies, to determine what lines of credit we qualify to receive. Since I didn’t learn about credit in school, I had to create my own classroom.

Find Your Teacher(s)

For as long as I can remember, both my Dad and my Aunt told me to manage my credit well. My Dad shared his own credit woes from early adulthood and encouraged me to make better decisions than he did when the time came to manage my own credit lines. My Aunt on the other hand, has successfully managed her credit from the age of 18, so her advice was more of an “imitate me and you too will succeed” type of message. Both of them made it very clear that my credit score would impact my lifestyle in adulthood and that there is value in a high credit score. What neither my Dad nor my Aunt told me, however, was exactly how to accomplish this feat.

“What I learned, however, is that debt is not the enemy! In fact, creditors like to see activity on borrowers’ credit accounts because it shows a history of his/her credit management habits. Who knew?“

After a few years of unsuccessfully trying to manage my credit on my own, I joined Facebook groups, subscribed to credit monitoring websites, and declined every credit card offer I received. For some reason, however, my credit score wasn’t increasing. It wasn’t until two years ago that I learned I was managing my credit all wrong. I’d been taught to avoid lines of credit because of interest rates and the potential decrease to my credit score if I’m unable to pay off the balances that I owed. What I learned, however, is that debt is not the enemy! In fact, creditors like to see activity on borrowers’ credit accounts because it shows a history of his/her credit management habits. Who knew?

Why Your Credit History Matters

In 2016, my Dad cosigned for my car loan and my credit score jumped over 50 points upon approval from the lender. By paying my full monthly car note either early or on time every month, I developed a positive payment history on my credit report. I also accepted three credit card offers and maintained the balances by using less than 30% of my available credit line. Through Facebook groups and my own research, I’ve learned that it’s better to allow my cards to report a balance so that lenders can see activity on my credit accounts. Once the balance is reported, I make sure to pay it off in full before the statement date so that I don’t have any interest added to the money I already owe the creditor. This process of allowing my low balances to report and also paying the balances in full before interest is applied has boosted my score from “fair” to “good” in less than a year. My “good” credit history and score allowed me to get utility bills in my name without needing a security deposit and to qualify for a low interest rate and monthly payments on a new car loan for a larger vehicle. Now when I go to apply for new lines of credit, creditors are more likely to approve me because I have a proven track record of successfully managing my debt.

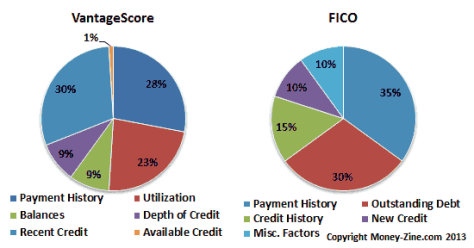

VantageScore vs. FICO score

Our credit scores can change each month, so it’s important to use a credible source to keep track of your credit profile. Creditkarma.com is one of the most well-known and widely used credit monitoring sites because its users have free access to their credit reports and credit scores. The only issue is that it reports users’ VantageScore which can be drastically different (higher or lower) than the credit scores most lenders use to determine a borrower’s credit worthiness. Myfico.com, however, requires a monthly payment for access to our FICO scores which are typically evaluated by creditors when we apply for lines of credit. The picture above displays how the two scores are calculated and what credit information is factored into the final numbers. While creditkarma.com is free to use, the benefits of having access to the credit information that most lenders typically use outweigh the burden of the required financial investment.

Be Proactive

Over the past few years, I have learned that it is imperative that we learn to manage our credit profiles well or they will limit us. Most young adults don’t take the time to learn about the importance of managing his/her credit until it’s either too late or until it’s needed. My hope is that reading this article, written by a 28 year old, inspires you to take a more aggressive approach when it comes to managing your credit. Don’t wait until life shows you that your credit score matters when you’re denied for a credit card or approved for a 20% interest rate on a $14,000 car loan. Invest the time and energy now into managing your credit information and reap the rewards because you deserve the lifestyle that a well-managed credit profile affords us.

Stay tuned for the next lesson that we didn’t learn in school but need to know.

–And remember,

Stay informed, open-minded, and driven